A Biased View of The Wallace Insurance Agency

Table of ContentsNot known Incorrect Statements About The Wallace Insurance Agency How The Wallace Insurance Agency can Save You Time, Stress, and Money.Getting The The Wallace Insurance Agency To WorkSome Known Incorrect Statements About The Wallace Insurance Agency The Wallace Insurance Agency Can Be Fun For Everyone

Like term life insurance, whole life policies supply a fatality benefit and various other advantages that we'll obtain right into later. The major benefit of a whole life plan is that it develops money worth.The distinction is that it offers the plan proprietor a lot more versatility in terms of their costs and cash money value. Whereas a term or entire life plan secure your rate, an universal policy permits you to pay what you're able to or want to with each costs. It likewise enables you to adjust your survivor benefit throughout the policy, which can not be finished with various other kinds of life insurance coverage.

If you have dependents, such as youngsters, a partner, or moms and dads you're caring for and lack substantial wide range it might be in your finest passion to acquire a plan even if you are fairly young. https://www.intensedebate.com/people/wallaceagency1. Needs to anything occur to you, you have the tranquility of mind to recognize that you'll leave your liked ones with the financial ways to work out any kind of continuing to be expenditures, cover the prices of a funeral service, and have some money left over for the future

The 10-Second Trick For The Wallace Insurance Agency

Motorcyclists are optional modifications that you can make to your plan to increase your protection and fit your demands. Usual motorcyclists include: Accidental fatality and dismemberment - Insurance quotes. This cyclist prolongs your coverage and can attend to your household in case of a crash that leads to a special needs or fatality (i

Lasting treatment. If a plan proprietor needs funds to cover long-term treatment expenses, this rider, when turned on, will certainly provide month-to-month repayments to cover those prices. Costs waiver. This rider can waive premiums after that occasion so coverage is not shed if the policy owner can not pay the regular monthly prices of their plan.

Car insurance coverage pays for covered losses after a collision or case, shielding against feasible monetary loss. Depending upon your coverage, a plan can shield you and your travelers. A lot of states require drivers to have vehicle insurance coverage.

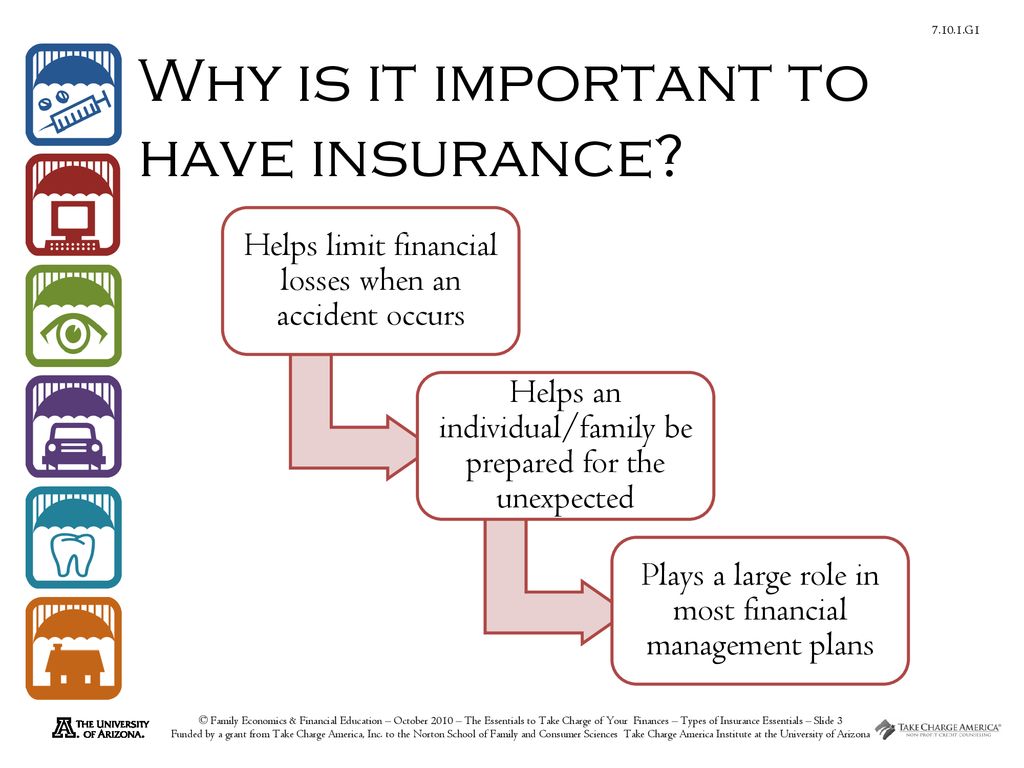

There are various kinds of insurance coverage items like life insurance policy strategies, term insurance coverage, health and wellness insurance coverage, home insurance coverage and even more. The core of any type of insurance coverage strategy is to offer you with defense. Supplying protection and reducing your risk is the straightforward intention of insurance. Making that tiny investment in any kind of insurance policy plans, will allow you to be tension-free and deal safety ahead of time.

The Greatest Guide To The Wallace Insurance Agency

Together with the life cover, they also give maturation advantage, causing a terrific cost savings corpus for the future. A treasured property like your vehicle or bike likewise needs security in the type of automobile insurance policy in order to secure you from expense expenditures in the direction of it repair services or uneventful loss.

This is where a term insurance plan comes in handy. Safeguard the future of your family members and buy a term insurance coverage plan that will certainly help your candidate or dependent receive a swelling amount or monthly payment to assist them deal with their financial needs.

The Definitive Guide to The Wallace Insurance Agency

Secure your life with insurance policy and ensure that you live your life tension-free. this article Secure you and your family members with the insurance coverage of your health insurance policy that will certainly give for your healthcare costs.

Life insurance policy plans and term insurance policies are very crucial to safeguard the future of your family members, in your lack (Insurance policy). You can have a full assurance, when you take care of the unpredictabilities of life with insurance policy. Insurance is a terrific financial investment network also. Life insurance policy plans facilitates systematic financial savings by alloting funds in the type of costs annually.

Insurance encourages savings by reducing your expenditures in the future. You can avoid expense repayments for regrettable occasions like clinical disorders, loss of your bike, crashes and even more. It is also a great tax obligation saving device that assists you reduce your tax obligation concern. Insurance coverage offers for an effective threat monitoring in life.